Federal Income Tax Table 2014

This is for the tax year ending Dec. Printable 2014 federal tax forms 1040EZ 1040A and 1040 are grouped below along with their most commonly filed supporting IRS schedules worksheets 2014 tax tables and instructions for easy one page access.

Irs Announces 2014 Tax Brackets Standard Deduction Amounts And More Income Tax Brackets Tax Brackets Federal Income Tax

Prepare and e-File your 2020 Taxes by April 15 2021.

Federal income tax table 2014. Add up your pretax deductions including 401K. Internal Revenue Service 2014 Instructions for Form 1120. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

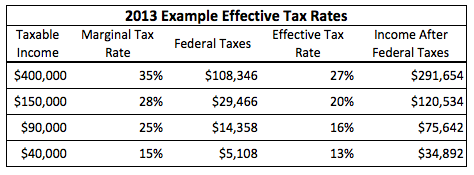

Married Individuals Filling Seperately. Corporate Tax Rate Schedule 2014. Below is an example salary after tax deductions based on the 2013 - 2014 tax tables.

Find your pay period. 2014 INCOME TAX WITHHOLDING INSTRUCTIONS CHARTS AND TABLES State of Vermont Department of Taxes Taxpayer Services Division PO. If Taxable Income.

Weekly biweekly semi-monthly monthly or daily 2. Currently you can only prepare and eFile 2020 Tax Returns. 15 2021 to e-File 2020 Tax Returns however if.

8 rows So for example assuming no deductions if you earned 9076 1 above the. Box 547 Montpelier VT 05601-0547 Emailbustaxstatevtus Phone. Income Over But Not Over.

Find your gross income for each paycheck 3. Over 73800 but not over 148850. Canada 2014 Tax Tables with Federal Provincial and Territorial personal income tax rates and tax credits.

2014 Tax Table k. TY 2014 Federal Income Tax Tables and Rates The IRS has released individual income tax rates for tax year 2014. Federal Income Tax Tables and Rates For 2014 Tax Season.

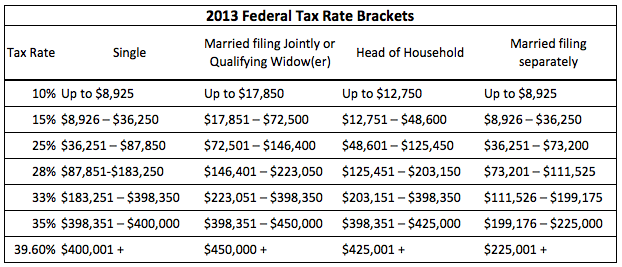

1 The top marginal income tax rate of 396 percent will hit taxpayers with an adjusted gross income of 406751 and higher for single filers and 457601 and higher for married filers. Over 18150 but not over 73800. April 15th 2014 or the 2013 tax filing due date is not that far away.

2014 tax tables with supporting tax calculator and historical Tax Tables for Canada. Taxable Income Over But Not Over. 7 rows 2014 Federal Income Tax Rates.

R23470000 Salary Income Tax. Also new for tax year 2013 whether paying quarterly estimated taxes or filing in April 2014 the top tax rate is 396 percent for individual income over 400000 or 450000 for married. One of a suite of free online calculators provided by the team at iCalculator.

Instructions on how to file a 2014 IRS or State Tax Return are are below. In 2014 the income limits for all brackets and all filers will be adjusted for inflation and will be as follows Table 1. Taxvermontgov Effective 01012014 Exp.

How to calculate Federal Tax based on your Annual Income. At Least But Less Than SingleMarried ling jointly Married ling sepa-rately Head of a house-hold Your taxis 25200 25250 25300 25350 3330 3338 3345 3353 Sample Table 25250 25300 25350 25400 2876 2884 2891 2899 3330. Over 148850 but not over 226850.

The latest available tax rates are for 2022 and the Federal income tax brackets have been changed since 2013. The 2014 Tax Calculator uses the 2014 Federal Tax Tables and 2014 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Which means its time to do some serious tax planning so that by year end you maximize your income while minimizing your taxes dues when filing in 2014. Income Tax Tables are used to calculated individual salaries apply tax deductions and tax credits to produce a net take home pay your income after deductions. Add up your income exemptions for each paycheck 4.

1016250 plus 25 of the excess over 73800. R26210000 Salary Income Tax. Below is an example salary after tax deductions based on the 2013 - 2014 tax tables.

How to Calculate 2014 Federal Income Tax by Using Federal Withholding Tax Table 1. For most US individual tax payers your 2014 federal income tax forms were due on April 15 2015 for income earned from January 1 2014. Income Tax Tables are used to calculated individual salaries apply tax deductions and tax credits to produce a net take home pay your income after deductions.

Of the Amount Over 0 50000 15 0 50000 75000 7500 25 50000. 802 828-2551 option 3 Fax. You have until Oct.

Of the Amount Over 0 50000 15 0. You can no longer e-File a 2014 Federal or St ate Tax Return anywhere. 1815 plus 15 of the excess over 18150.

See the instructions for line 44 to see if you must use the Tax Table below to figure your tax. 10 of the taxable income. 1040 Tax Forms For 2014.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2014 Tax Brackets Tax Schedule 2020

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

2014 Federal Income Tax Brackets Irs Marginal Tax Rates

Income Tax Formula Excel University

Income Tax Formula Excel University

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Proposal Writer Tax Software

Understanding Taxes Earned Income Credit

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Income Tax Formula Excel University

2014 Federal Income Tax Brackets Nerdwallet

T20 0237 Average Federal Individual Income Tax Liability By Adjusted Gross Income Level 2016 Tax Policy Center

Tax Policy And Economic Inequality In The United States Wikipedia

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Posting Komentar untuk "Federal Income Tax Table 2014"